Strategy on TradingView

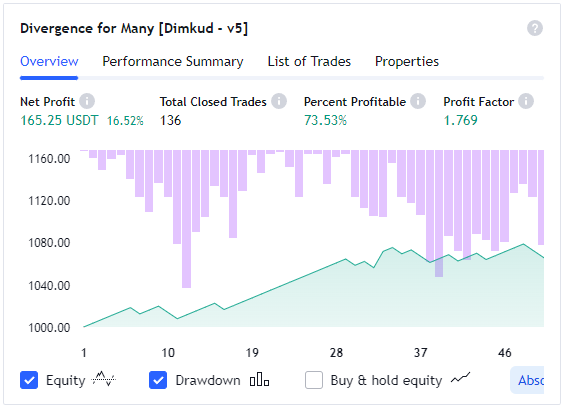

Divergence for Many [Dimkud – v5]

it showing good results in backtests.

Here you can download the .CSV file with settings to the Strategy on Tradingview – “Divergence for Many [Dimkud – v5]”

Settings for Strategy.

It’s text file, you can view it in notepad or upload directly to the settings of strategy.

These settings are tested on 1INCHUSDT , 45m chart.

Content of this settings file:

Name,Value

“__indicatorName”,”Divergence for Many [Dimkud – v5]”

“Display Visualisation for TP/SL ?”,false

“Use Long ?”,false

“Use Short ?”,true

“SL = TP ?”,false

“Use Opposite Signal SL ?”,false

“Take Profit (%)”,1.3

“Stop Loss (%)”,1.9

“Start Year”,2022

“Stop Year”,2030

“Pivot Period(9)”,5

“Source for Pivot Points”,”Close”

“Show Indicator Names”,”Don’t Show”

“Maximum Pivot Points to Check”,10

“Maximum Bars to Check”,100

“Show Divergence Number”,true

“Show Only Last Divergence”,false

“Don’t Wait for Confirmation”,false

“Show Divergence Lines”,false

“Show Pivot Points”,false

“MACD”,false

“Fast(12):”,12

“Slow(26):”,26

“Sign(9):”,9

“MACD Histogram”,false

“RSI”,true

“RSI period (14):”,10

“Stochastic”,false

“STOCH Length(14):”,14

“CCI”,false

“CCI Length(10)”,10

“Momentum”,false

“Momentum Length(10)”,10

“OBV”,true

“VWmacd”,false

“Volume Weighted Macd. Fast(12)”,12

“Slow(26)”,26

“Chaikin Money Flow”,true

“CMF period(21)”,24

“Money Flow Index”,true

“Mfi length(14)”,19

“Williams_Vix_Fix”,true

“Williams_Vix_Fix Period(21)”,31

“Use Stochastic RSI ?”,true

“Stochastic K(3)”,1

“RSI Length(14)”,8

“Stochastic Length(14)”,12

“Use SMIO ?”,false

“Long Length(20)”,20

“Short Length(5)”,5

“Signal Line Length(5)”,5

“Use VWMACD_LB ?”,true

“Short period(12)”,21

“Long period(26)”,22

“Smoothing period(9)”,10

“Use BBP”,true

“BBP Length(13)”,12

“Use BOP”,true

“BOP Smooth Length(20)”,16

“TRIPLE Smooth Length(20)”,20

“Use RVI”,true

“RVI length(10)”,9

“MA Type”,”WMA”

“MA Length(14)”,20

“Logistic Dominance”,true

“Map Length(13)”,5

“Dominance(5)”,5

“Check External Indicator”,false

“External Indicator”,”close”

“Regular Divergence Line Style”,”Solid”

“Hdden Divergence Line Style”,”Dashed”

“Regular Divergence Line Width”,2

“Hidden Divergence Line Width”,1

“Show MAs 50 & 200”,false

“Use Channel ?”,false

“Channel to Use:”,”Bollinger Bands”

“Enter Conditions”,”Wick out of band”

“Keltner Long.”,14

“Keltner Mult.”,1.5

“BB Long.”,20

“BB Deviation (Desv.)”,2

“RSI TF Long(14):”,14

“RSI TimeFrame:”,”2 hours”

“Use RSI LONG Range”,false

“(LONG) RSI is More”,30

“& RSI Less”,70

“Use RSI SHORT Range”,false

“(SHORT) RSI is Less”,70

“& RSI More”,30

“RSI TF Long(14):[2]”,14

“RSI TimeFrame:[2]”,”Chart”

“Use RSI LONG Range[2]”,false

“(LONG) RSI is More[2]”,30

“& RSI Less[2]”,70

“Use RSI SHORT Range[2]”,false

“(SHORT) RSI is Less[2]”,70

“& RSI More[2]”,30

“MFI TF Long:”,14

“MFI TimeFrame:”,”Chart”

“Use MFI LONG Range”,false

“(LONG) MFI is More”,10

“& MFI Less”,60

“Use MFI SHORT Range”,false

“(SHORT) MFI is Less”,95

“& MFI More”,50

“ATR length1 (20)(5)”,7

“ATR length2 (100)(20)”,100

“ATR Smoothing”,”SMA”

“Use ATR1 <> ATR2 ?”,true

“ATR1 to ATR2″,”ATR1 < ATR2”

“Use VOL1 <> VOL2 ?”,false

“VOL1 to VOL2″,”VOL1 < VOL2”

“VOL length1 (20)(5)”,20

“VOL length2 (100)(20)”,100

“VOL Smoothing”,”WMA”

“CCI TF Long(14):”,14

“CCI TimeFrame:”,”Chart”

“Use CCI LONG Range”,false

“(LONG) CCI is More”,-400

“& CCI Less”,400

“Use CCI SHORT Range”,true

“(SHORT) CCI is Less”,400

“& CCI More”,10