Veles Finance (https://algotradinginfo.com/veles) has launched automated trading on its platform using signals from our strategy “Multi Scalping Strategy [Dimkud]”.

We have selected a few configurations/settings (currently 17 coins and will expand further), which have shown the best profit in backtesting for the last 7 months.

This way, to trade with our signals – you don’t need to figure out how to set up our strategy on TradingView yourself, you don’t need to select settings for each coin. You do not need a paid account on TradingView.

You just need to register on the Veles platform and purchase access to our signals in the Marketplace, which are called “Dimkud Multi Intraday”.

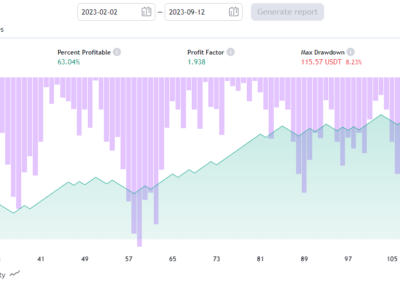

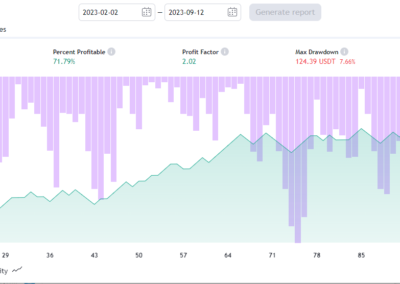

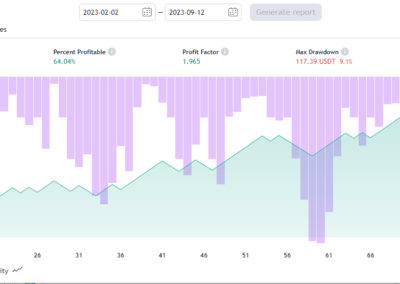

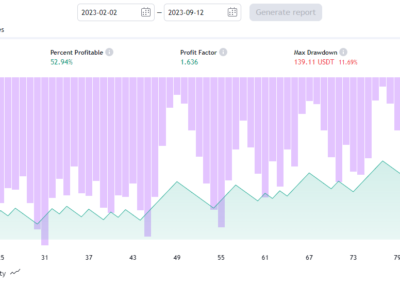

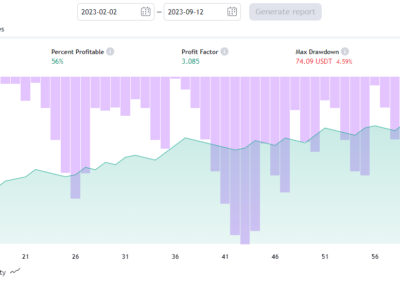

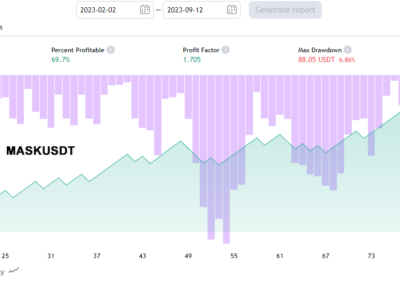

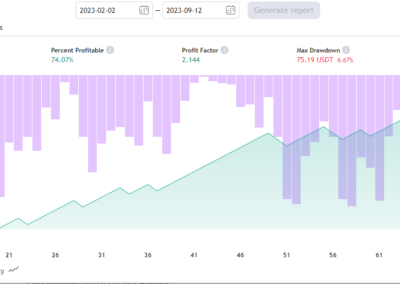

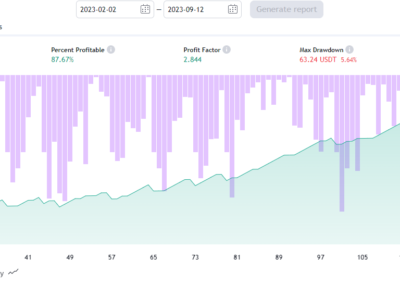

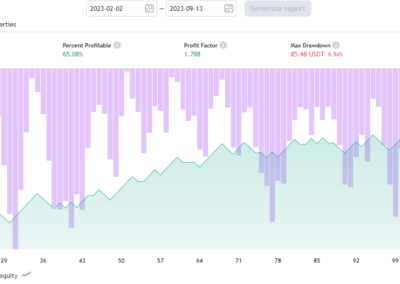

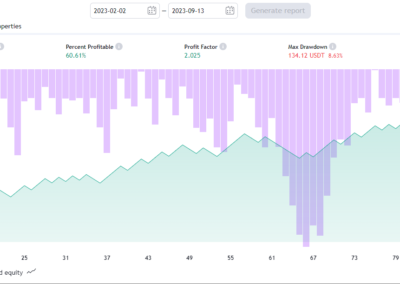

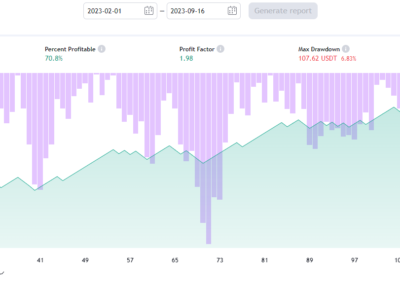

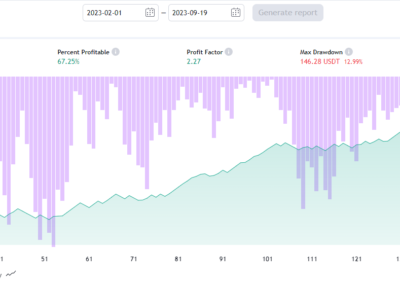

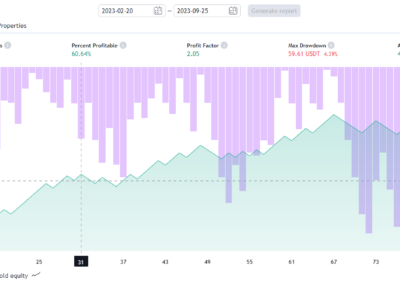

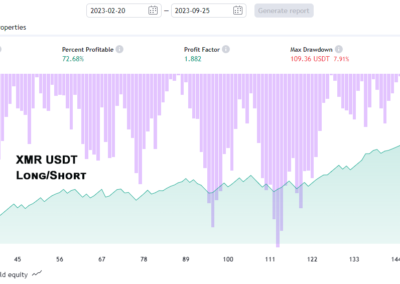

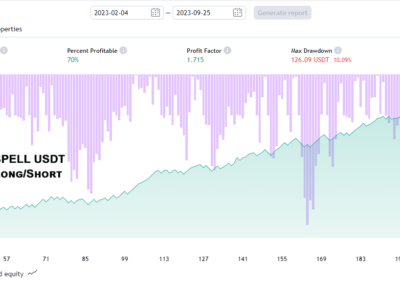

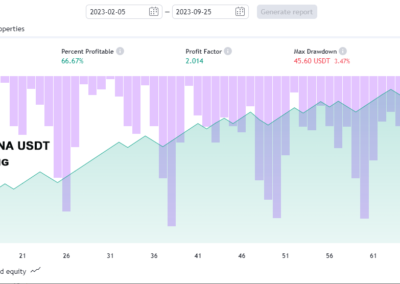

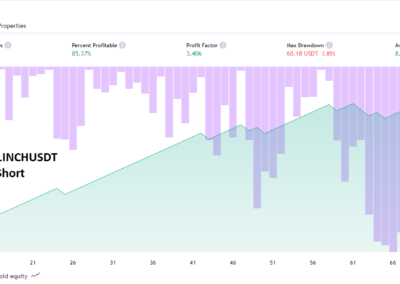

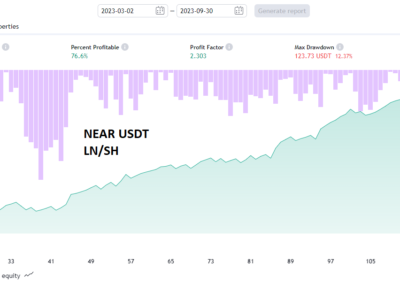

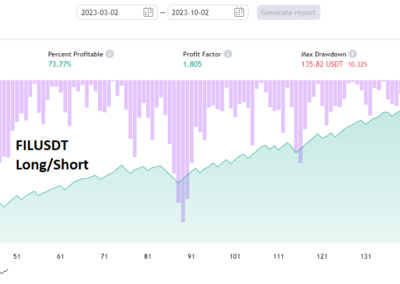

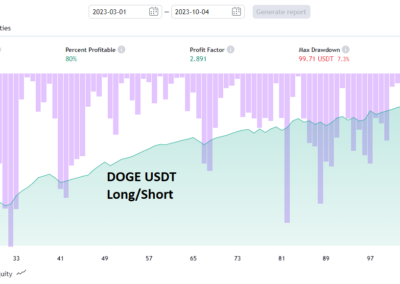

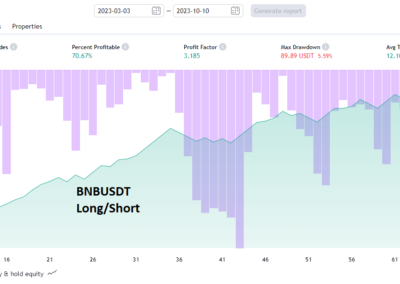

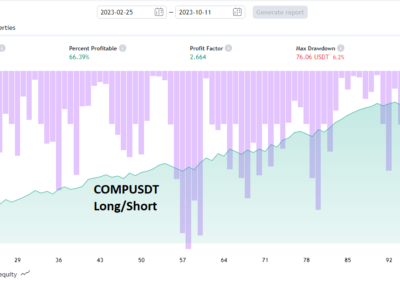

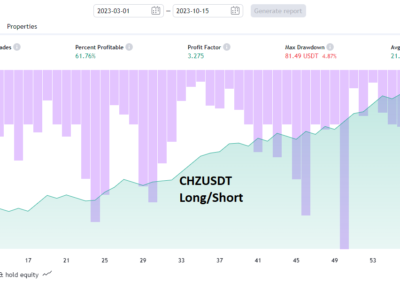

Above are screenshots of backtests.

What can be understood from them:

This backtest is for the past 7 months.

In the settings of the tester is enabled: deposit 1000$, order size 1000$, i.e. 100%. (this affects the percentages you see in the tester, but all ratios will be the same for any amounts)

This means we trade as if without using leverage on the exchange. (we have 1000$ and we open a deal with 1000$). If we apply leverage, for example x10, the profit will increase 10 times, but the maximum drawdown will increase 10 times.

Looking at these backtests and comparing – you can roughly compare which results are better, where the profit is more, but the maximum drawdown is less. (this ratio is important, the less drawdown to profit the better).

Let me tell you what you can see here:

Consider for example the image of APEUSDT:

96 orders in 7 months. This is about 1 order every 2 days.

Profit for the test period is 82%, maximum drawdown is 5.6%.

(I remind you, this is calculated without leverage on the stock exchange, but with trading the whole amount for each trade )

Profitable trades 63%

Profit factor 2.1 (anything more than 1 is like profit, but preferably it should be more than 1.5).

And it is important to understand Purple stripes from top to bottom, this is Drawdown. If everything is lower and lower than the stripes, it means that there is negative after negative. It is necessary to understand that there are several SLs in a row.

This once again confirms that you need to trade with a small amount of money for each trade.

How to create a bot to trade using signals.

1. You need to buy access to “Dimkud Multi Intraday” signals in the “Marketplace” section of your Veles account.

https://veles.finance/cabinet/marketplace

2. Just buying signals is not enough.

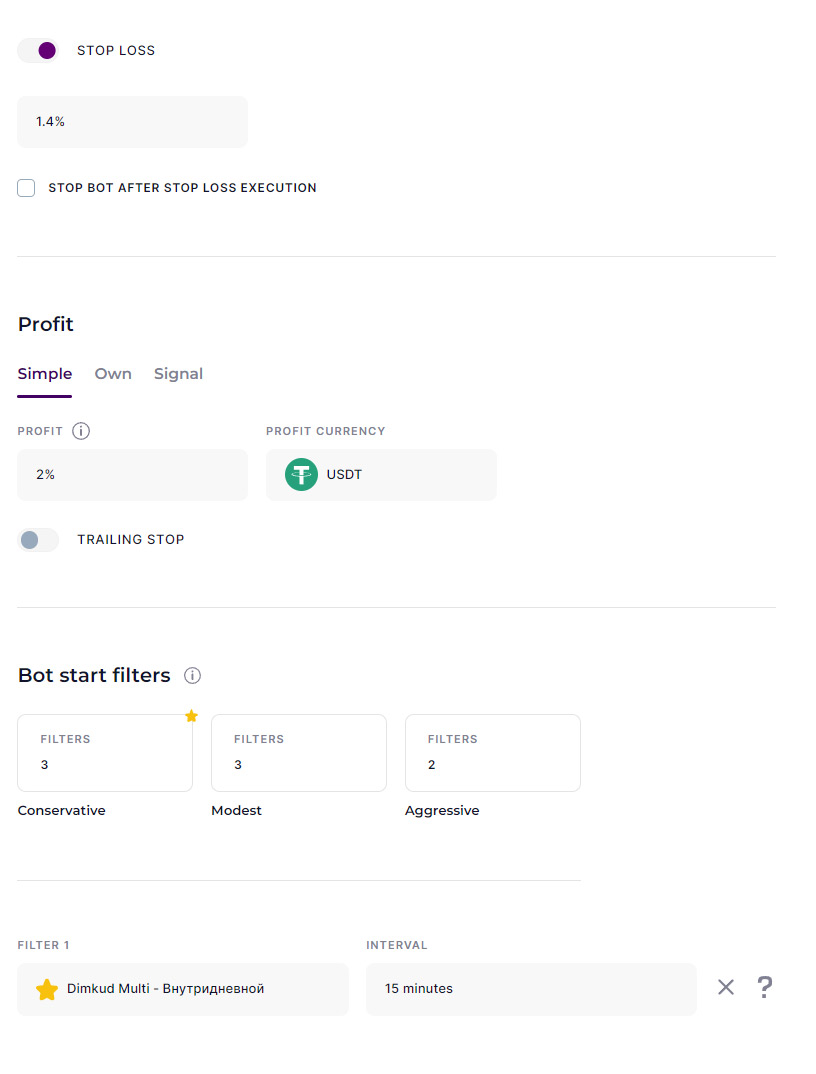

You also need to create bots, where you need to select these purchased signals (“Dimkud Multi Intraday”) as a Filter on Start, select the interval of 15 minutes.

As shown in the screenshot below.

You need to create a separate bot for each supported currencies. Set them up in the Short/Long trading mode. (as shown in ths settings below).

3. You can create bots with any parameters at your discretion. If you want to experiment. Signals can launch any bots.

I.e. it can be a bot with 1 order and stop loss, or a large grid of orders, with a large % of overlap, etc.

How to manually create a bot – see the Wiki on Veles:

https://help.veles.finance

For my part, I give bot settings for each coin, for one order, with Stop Loss and Take Profit parameters, which showed the highest profit in the backtest for the last 7 months.

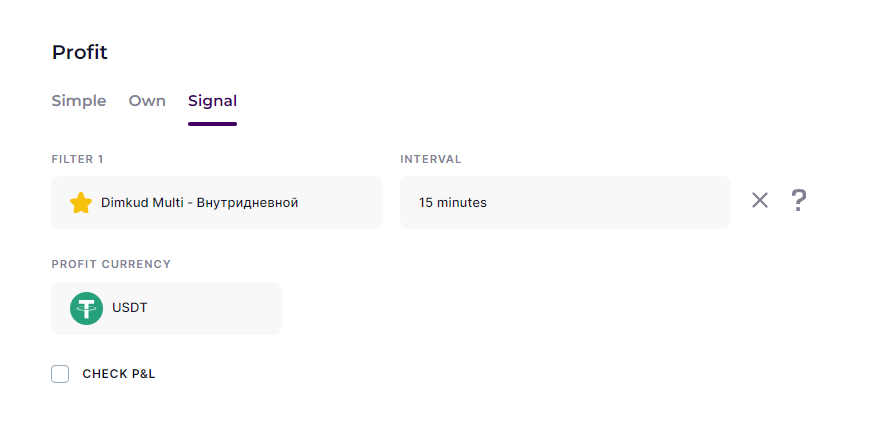

4. Also, for simplicity, I give links to a simple copy of all bot settings (additionally, do not forget to select “Dimkud Multi Intraday”, 15 min. in Filters for Start, and for bots in the “Long/Short” mode, it is also necessary to select “Signal” in the “Profit” section in the bot settings).

General bot settings:

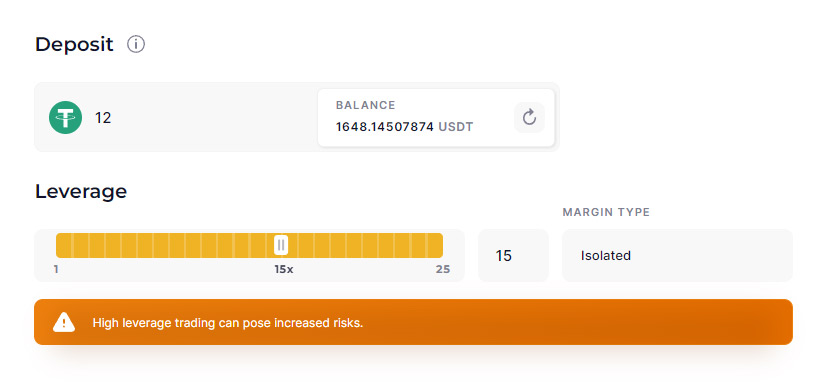

Amount and leverage:

If we decide to stick to low risk and want to lose only 1% of our deposit when receiving Stop Loss.

Then, if you have a deposit of $500, then you can lose ~5$

With an average stop loss of 2% (price movement), we will get minus $5 if we specify a deposit of $12 in the bot settings, with a leverage of 15x.

Or the same result if we indicate a deposit of $25 with a leverage of 7x.

Always use Isolated Margin.

Important: do not put leverage more than 20x.

Because your position will be liquidated faster than the price reaches the stop loss (if the SL is large, 2.5-3% of the price movement)

Further settings:

Trading mode “Own”, 1 order.

Stop Loss and Profit from the settings that I will give below.

Start Filter – “Dimkud Multi Intraday”, 15m.

Here are the settings of parameters (TP, SL, sometimes BU), which showed the best results on the backtest (those on the screens above).

I also give links to simple copying of all bot settings (don’t forget to select “Dimkud Multi Intraday” in filters for Start, and for bots in the “Long/Short” mode, it is also necessary to select “Signal” in the “Profit” section in the bot settings).

If it’s not there, don’t forget to buy it from the Marketplace

https://veles.finance/cabinet/marketplace

Settings for SHORT bots:

MANAUSDT

TP: 1.9%

SL: 2.1%

create this bot

GALUSDT

TP: 2.2%

SL: 2.7%

create this bot

API3USDT

TP1: indent 0.85% volume 5%

TP2: indent 1.4% volume 95%

Stop B/E by Average

SL: 2.8%

create this bot

APEUSDT

TP: 1.9%

SL: 1.3%

create this bot

MASKUSDT

TP: 1.7%

SL: 2.5%

create this bot

XRPUSDT

TP1: indent 1.25 volume 1%

TP2: indent 2.95 volume 5%

TP3: indent 4.4 volume 94%

Stop B/E by TP

SL: 1.3%

create this bot

LTCUSDT

TP: 3.3%

SL: 2.1%

create this bot

LINKUSDT

TP1: indent 1.6 volume 5%

TP2: indent 3.3 volume 95%

Stop B/E by Average

SL: 2.7%

create this bot

ATOMUSDT

TP: 2.6%

SL: 2.1%

create this bot

SOLUSDT

TP: 1.7%

SL: 1.1%

create this bot

SANDUSDT

TP1: indent 1.95 volume 5%

TP2: indent 2.6 volume 95%

Stop B/E by Average

SL: 2.1%

create this bot

1INCHUSDT

TP: 1.5%

SL: 2.3%

create this bot

(!! It is not recommended to trade 1INCH, SPELL on Bybit (possibly on other exchanges besides Binance). Because there these coins has a very large tick size (minimum price step))

(SPELLUSDT, XMRUSDT, OCEANUSDT, NEARUSDT, FILUSDT, DOGEUSDT, BNBUSDT, COMPUSDT, CHZUSDT)

(For these pairs, if desired, you can set up trading only in Short, as part of a trade in both directions. See settings below.)

Settings for trading in both directions Long/Short

For these currency pairs, you can set up trading with a reversal in both directions (Long/Short). If desired, you can configure it to trade only in one direction (in Veles, activate only one bot for this pair (either Long or Short))

Currently Long/Short mode is available for:

COMPUSDT

TP: Select “Signal”

SL: 2.2%

create this bot

OCEANUSDT

TP: Select “Signal”

SL: 2.8%

create this bot

XMRUSDT

TP: Select “Signal”

SL: 2.1%

create this bot

NEARUSDT

TP: Select “Signal”

SL: 2.7%

create this bot

FILUSDT

TP: Select “Signal”

SL: 2.7%

create this bot

DOGEUSDT

TP: Select “Signal”

SL: 2.5%

create this bot

BNBUSDT

TP: Select “Signal”

SL: 2.1%

create this bot

CHZUSDT

TP: Select “Signal”

SL: 2.4%

create this bot

SPELLUSDT

TP: Select “Signal”

SL: 3.0%

create this bot

(!! It is not recommended to trade SPELL on Bybit (possibly on other exchanges besides Binance). Because there Spell has a very large tick size (minimum price step))

Settings for LONG bots:

MANAUSDT

TP: 1.6%

SL: 1.3%

create this bot

+

(SPELLUSDT, XMRUSDT, OCEANUSDT, NEARUSDT, FILUSDT, DOGEUSDT, BNBUSDT, COMPUSDT, CHZUSDT)

(For these pairs, if desired, you can set up trading only in Long, as part of a trade in both directions. See settings below.)

How to setup trading in both directions Long/Short:

1. You need to create two identical bots for one currency pair.

(you can use the links above, each pair has its own)

2. Set one bot to Short, and the second to Long

3. For both bots, in the “Profit” section, replace it with “Signal”, and there select my signal with a Star (as in the screenshot below).

(you do not specify the size of the TP, but bot will close on a Signal)

4. Do NOT enable the “Check P&L” checkbox. Sometimes, on a signal, it can close in the loss (SL on a signal).

5. At the bottom in the filter for Start (for both bots) – also select Signal with a Star.

6. You can also create a bot that trades in only one direction (only Long or only Short). (just don’t create (or activate) a Short bot, but only activate a Long bot.)

How it will work:

If a signal comes for Short, and at that time there is an active Long,

then Long will close, Short will open. And vice versa.

And if a signal to Close (by profit) comes, then the bot that was open will simply close.

Recommendations on setting and money-management.

1. These signals are made on the basis of my strategy on Tradingview – “Multi Scalping”.

A combination of several indicators/filters was selected and adjusted to get the results.

Some of these settings were tested in real trading for several months. And for a long period showed a plus. (But there were some minus weeks.)

I took these settings as a basis and by analogy I picked up similar settings for other currencies.

2. Selected settings that show good results in the tester for the last 7 months. (backtests are shown above). Since the market is falling now, the biggest advantage is given by settings for Shorts, so I focused on them.

3. Signals are not scalper, with quick trades, but intraday, a trade lasts from a couple of hours to a couple of days.

TP and SL sizes ~1.5-3% .

For each pair is different. I will show you which ones I recommend.

Each bot for one order (not a grid), with Stop Loss and Take Profit.

The number of orders for each bot – on average 1 order every 2-3 days. (for 12 signals will be 3-5 orders per day).

4. When trading with stops – there are stops from time to time 🙂

And there are periods when stops are not single, but 2-3-4 in a row (such periods can be seen on backtests and in real trading).

If the whole market starts to move, then several bots can enter a deal almost simultaneously and stops from different bots will add up to one big minus every day.

Our task is to survive such periods.

Therefore, it may be necessary to launch not all bots at once and it is necessary not to surpass the acceptable amount of losses for you for each Stop Loss.

5. Be sure to use the function of Veles – “Blocking:”

https://veles.finance/cabinet/account/locks

So that not too many bots come in at the same time.

(This applies not only to my signals but to all of them. In case of big market movements bots like to get stops massively)

6. Use normal risk/management.

I have read a lot of articles. I liked such recommendations – make an order for such an amount that a possible Stop Loss would bring you a maximum of 1%-2%-3% loss from your deposit (in $). And we have several bots that go together!

I recommend setting up (at least for the beginning) so that the size of Stop Loss (in $) from each trade was not more than 1% of your deposit!

Then you will not lose everything at once, even with a bad period in the market.

We need our deposit to survive the periods of massive stop losses and wait for the period of massive profits.