Стратегія на TradingView

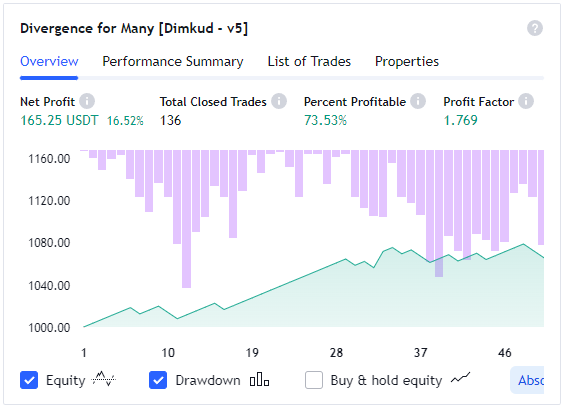

Divergence for Many [Dimkud – v5]

він показує хороші результати у бектестах.

Тут ви можете завантажити файл .CSV з налаштуваннями до Стратегії на Tradingview – “Дивергенція для багатьох [Дімкуд – v5]”

Налаштування для стратегії.

Це текстовий файл, який можна переглянути в блокноті або завантажити прямо в налаштування стратегії.

Ці настройки протестовані на 1INCHUSDT, 45-метровому графіку.

Зміст файла:

Name,Value

“__indicatorName”,”Divergence for Many [Dimkud – v5]”

“Display Visualisation for TP/SL ?”,false

“Use Long ?”,false

“Use Short ?”,true

“SL = TP ?”,false

“Use Opposite Signal SL ?”,false

“Take Profit (%)”,1.3

“Stop Loss (%)”,1.9

“Start Year”,2022

“Stop Year”,2030

“Pivot Period(9)”,5

“Source for Pivot Points”,”Close”

“Show Indicator Names”,”Don’t Show”

“Maximum Pivot Points to Check”,10

“Maximum Bars to Check”,100

“Show Divergence Number”,true

“Show Only Last Divergence”,false

“Don’t Wait for Confirmation”,false

“Show Divergence Lines”,false

“Show Pivot Points”,false

“MACD”,false

“Fast(12):”,12

“Slow(26):”,26

“Sign(9):”,9

“MACD Histogram”,false

“RSI”,true

“RSI period (14):”,10

“Stochastic”,false

“STOCH Length(14):”,14

“CCI”,false

“CCI Length(10)”,10

“Momentum”,false

“Momentum Length(10)”,10

“OBV”,true

“VWmacd”,false

“Volume Weighted Macd. Fast(12)”,12

“Slow(26)”,26

“Chaikin Money Flow”,true

“CMF period(21)”,24

“Money Flow Index”,true

“Mfi length(14)”,19

“Williams_Vix_Fix”,true

“Williams_Vix_Fix Period(21)”,31

“Use Stochastic RSI ?”,true

“Stochastic K(3)”,1

“RSI Length(14)”,8

“Stochastic Length(14)”,12

“Use SMIO ?”,false

“Long Length(20)”,20

“Short Length(5)”,5

“Signal Line Length(5)”,5

“Use VWMACD_LB ?”,true

“Short period(12)”,21

“Long period(26)”,22

“Smoothing period(9)”,10

“Use BBP”,true

“BBP Length(13)”,12

“Use BOP”,true

“BOP Smooth Length(20)”,16

“TRIPLE Smooth Length(20)”,20

“Use RVI”,true

“RVI length(10)”,9

“MA Type”,”WMA”

“MA Length(14)”,20

“Logistic Dominance”,true

“Map Length(13)”,5

“Dominance(5)”,5

“Check External Indicator”,false

“External Indicator”,”close”

“Regular Divergence Line Style”,”Solid”

“Hdden Divergence Line Style”,”Dashed”

“Regular Divergence Line Width”,2

“Hidden Divergence Line Width”,1

“Show MAs 50 & 200”,false

“Use Channel ?”,false

“Channel to Use:”,”Bollinger Bands”

“Enter Conditions”,”Wick out of band”

“Keltner Long.”,14

“Keltner Mult.”,1.5

“BB Long.”,20

“BB Deviation (Desv.)”,2

“Use VWmacd TimeFrame”,false

“VWM TimeFrame:”,”Chart”

“VWM fastperiod”,12

“VWM slowperiod”,26

“VWM signalperiod”,9

“Use HistVWM Rising (Long) ?”,false

“HistVWM Rising Lengh:”,3

“Use HistVWM Falling (Short) ?”,true

“HistVWM Falling Lengh:”,3

“RSI TF Long(14):”,14

“RSI TimeFrame:”,”2 hours”

“Use RSI LONG Range”,false

“(LONG) RSI is More”,1

“& Less”,70

“Use RSI SHORT Range”,false

“(SHORT) RSI is Less”,70

“& More”,30

“RSI TF Long(14):[2]”,18

“RSI TimeFrame:[2]”,”3 hours”

“Use RSI LONG Range[2]”,false

“(LONG) RSI is More[2]”,1

“& Less[2]”,55

“Use RSI SHORT Range[2]”,false

“(SHORT) RSI is Less[2]”,70

“& More[2]”,30

“MFI TF Long:”,14

“MFI TimeFrame:”,”Chart”

“Use MFI LONG Range”,false

“(LONG) MFI is More”,30

“Use MFI SHORT Range”,false

“(SHORT) MFI is Less”,70

“ATR length1 (20)(5)”,7

“ATR length2 (100)(20)”,100

“ATR Smoothing”,”SMA”

“Use ATR1 <> ATR2 ?”,true

“ATR1 to ATR2″,”ATR1 < ATR2”

“CCI TF Long(14):”,14

“CCI TimeFrame:”,”Chart”

“Use CCI LONG Range”,false

“(LONG) CCI is More”,10

“Use CCI SHORT Range”,true

“(SHORT) CCI is Less”,400